- Blog

- Demand for Hydrogen-Fuelled Vehicles in Europe - Should Dealers Pay Attention?

Demand for Hydrogen-Fuelled Vehicles in Europe - Should Dealers Pay Attention?

Find out where hydrogen vehicles stand in Europe today, how they compare to EVs, and what car dealers should know about future demand and opportunities.

Кључни подаци

- Hydrogen-powered vehicles are still rare in the used car market, especially when it comes to passenger cars.

- High costs and limited refuelling infrastructure are still the biggest challenges that slow down FCEV adoption.

- Currently, the commercial segment is growing the most, with fleets, buses, and trucks leading the way.

You may have heard of hydrogen-fuelled vehicles, or FCEVs (fuel cell electric vehicles), in the context of zero-emission mobility or pilot projects testing new technology. Still, your dealership probably isn’t brimming with FCEVs on its lot.

You’re not alone. This technology is still niche, expensive, and it heavily depends on infrastructure that barely exists in most parts of Europe.

But since we may hear more about it in the near future, it’s best to stay informed and understand in which direction things are going. So, let’s see the outlook for FCEVs in Europe and whether it’s something that traders should keep in mind.

Hydrogen vehicle demand dynamics since 2022

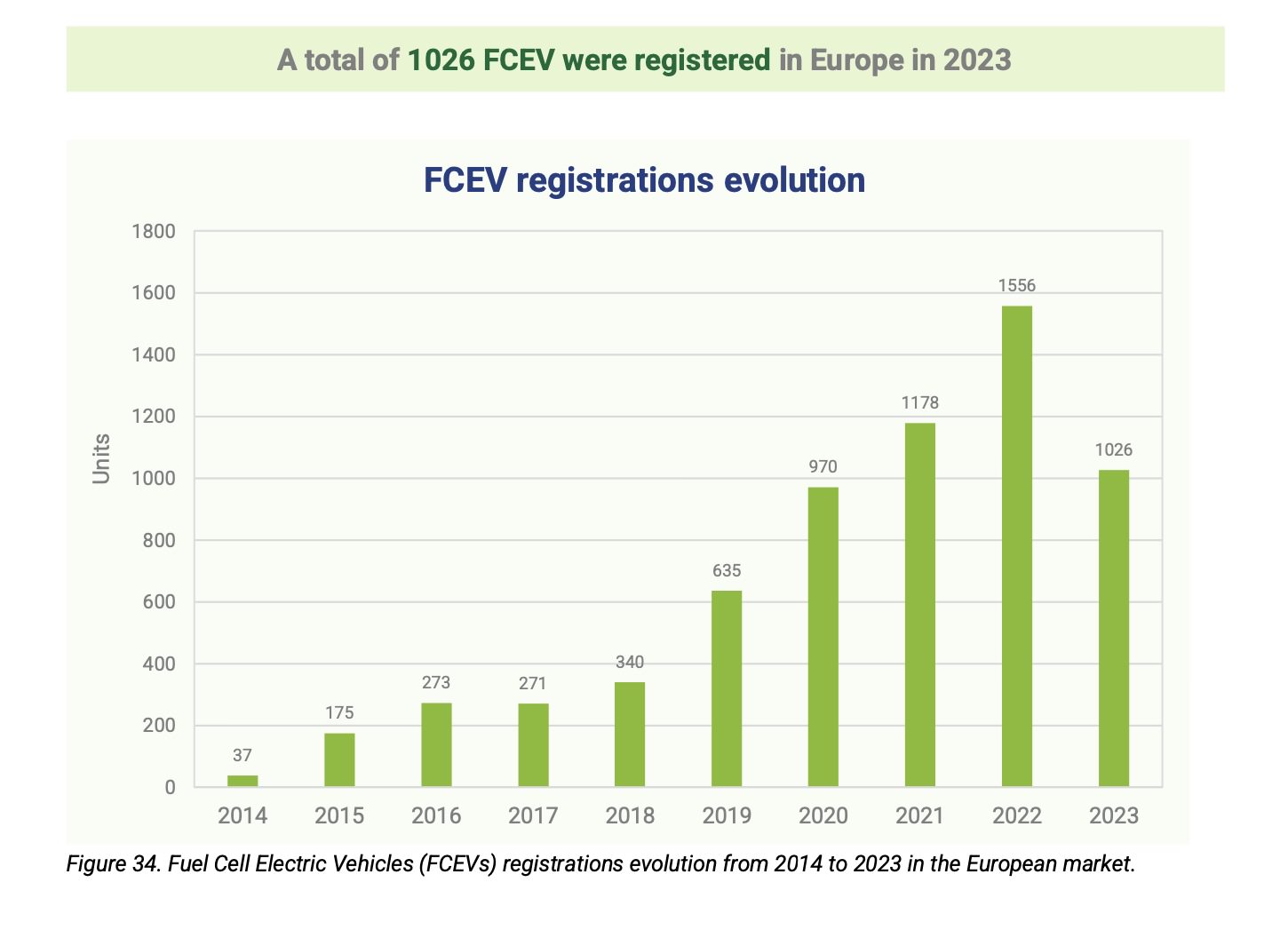

Fuel cell car adoption didn’t follow a straight path. After a few years of growth, registrations jumped by 31% in 2022, but then decreased again in 2023.

You can see the trend clearly in the chart below.

Source: European Hydrogen Observatory

Just like electric cars, hydrogen vehicles go through ups and downs depending on elements like infrastructure, prices, and government support.

Note that the trends are different with passenger cars and commercial vehicles, so it’s worth looking at each segment separately.

FCEV stagnation/drop in the passenger car market

When it comes to regular passenger cars, FCEVs still aren't nearly as popular as electric vehicles are.

In 2023, there were 4,938 hydrogen passenger cars on European roads. That’s only a 2.8% increase from 2022, so the growth is relatively insignificant.

Here’s how passenger cars compare to other FCEV types, according to a European Hydrogen Observatory report:

|

Vehicle type |

Number of FCEVs in 2023 |

Change from 2022 |

|

Passenger cars |

4,938 |

+2.8% |

|

Vans (N1) |

322 |

-0.3% |

|

Buses (M2 & M3) |

464 |

+38.9% |

|

Trucks (N2 & N3) |

215 |

+97.3% |

As you can see, hydrogen cars are growing much more slowly than hydrogen trucks and buses.

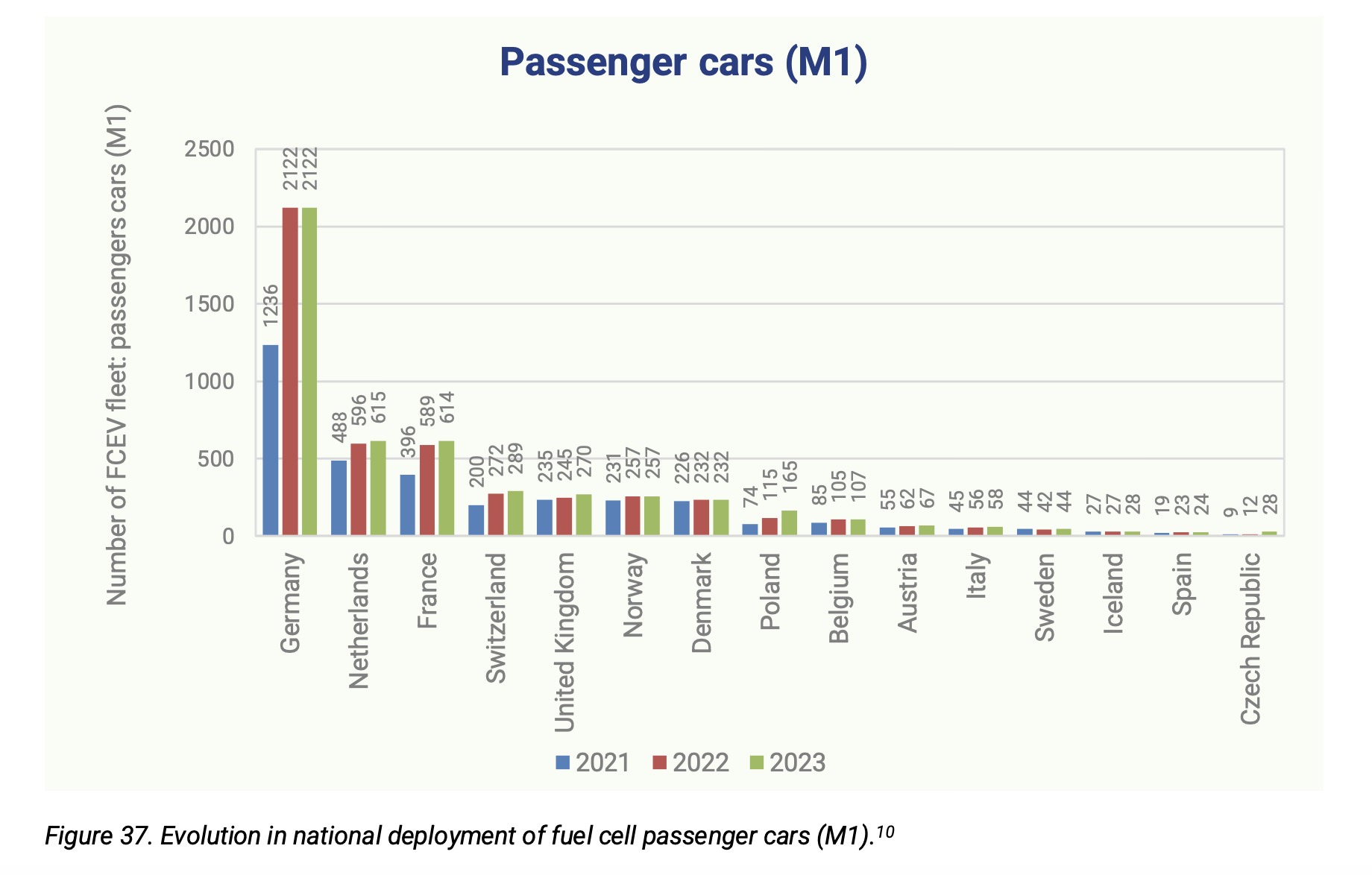

If you look at where these cars are actually on the road, you’ll notice that most of the FCEV passenger fleet is concentrated in just a few countries.

Source: European Hydrogen Observatory

Source: European Hydrogen Observatory

Germany is leading the way, with over 2,100 hydrogen passenger cars on the road. The Netherlands and France are next, both just over 600. In most other countries, the numbers are still pretty small.

Hydrogen’s strength is in the commercial vehicle segment

In contrast, hydrogen is getting more popular in commercial vehicles. In 2023, FCEV vans, buses, and trucks made up about 1,000 vehicles in total across Europe.

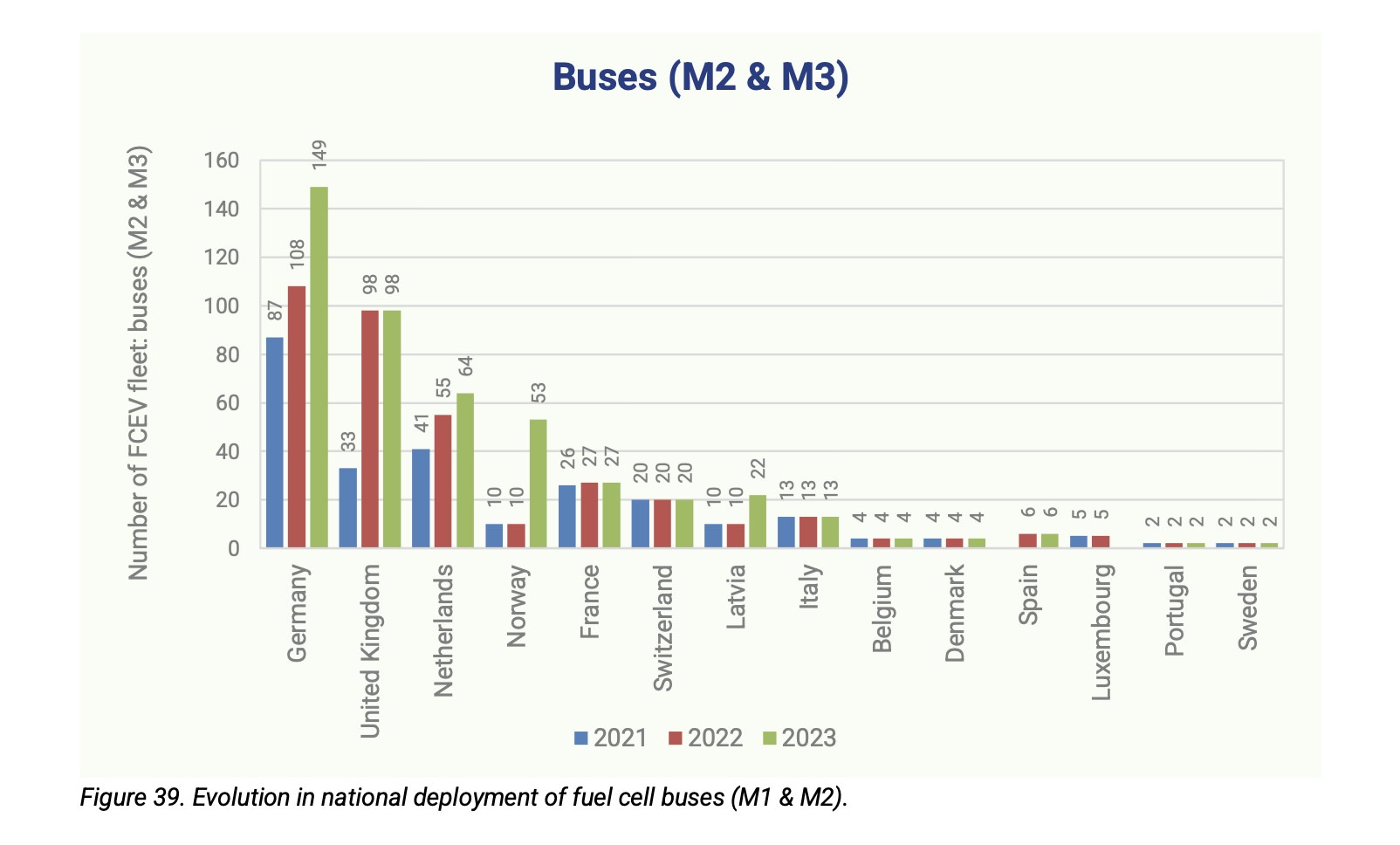

Hydrogen buses are spreading the most.

Germany leads with 149 fuel cell buses, followed by the UK and the Netherlands. Many other countries have started adding small fleets as well.

Source: European Hydrogen Observatory

As for vans, France completely dominates, with 273 out of 322 vehicles across Europe. The numbers haven’t really changed since 2021, and other countries are barely involved.

Trucks, on the other hand, are becoming more common. Switzerland, the UK, Norway, the Netherlands, and Germany all added hydrogen trucks in 2023.

So, while passenger cars are moving slowly, there might be a realistic future for the commercial segment.

Is the trend changing? The future of FCEV cars

Based on the Hydrogen Observatory data, we can see that FCEVs aren’t that obscure anymore.

Still, we can’t expect to see FCEVs on our streets regularly in the near future, at least not with so few public hydrogen refuelling stations. So, let’s see what our realistic expectations can be for the coming years.

Realistic forecast for 2025-2030 in Europe

Experts expect the European hydrogen car industry to grow. According to Research and Markets, the market was around $438 million in 2023 and could hit $3.8 billion by 2033. That’s roughly a 24% annual growth rate.

While the industry as a whole is expected to grow, note that we likely won’t see many used passenger FCEVs on the market.

Hydrogen commercial vehicles might have better chances.

As more cities invest in clean transport (through NOx tax initiatives, for example) and logistics companies look for low-emission options, demand for hydrogen vans, buses, and trucks is expected to rise.

Should you focus on hydrogen cars as a car dealer?

To put it simply, if your used car dealership mostly sells to private buyers, hydrogen probably isn’t worth chasing right now.

But if you often work with fleets of commercial vehicles, it might be smart to keep an eye on hydrogen. It could turn into a useful niche down the line.

Main issues with mass adoption of hydrogen-powered vehicles

Why aren’t FCEVs more widespread? There are two main factors behind the slow adoption.

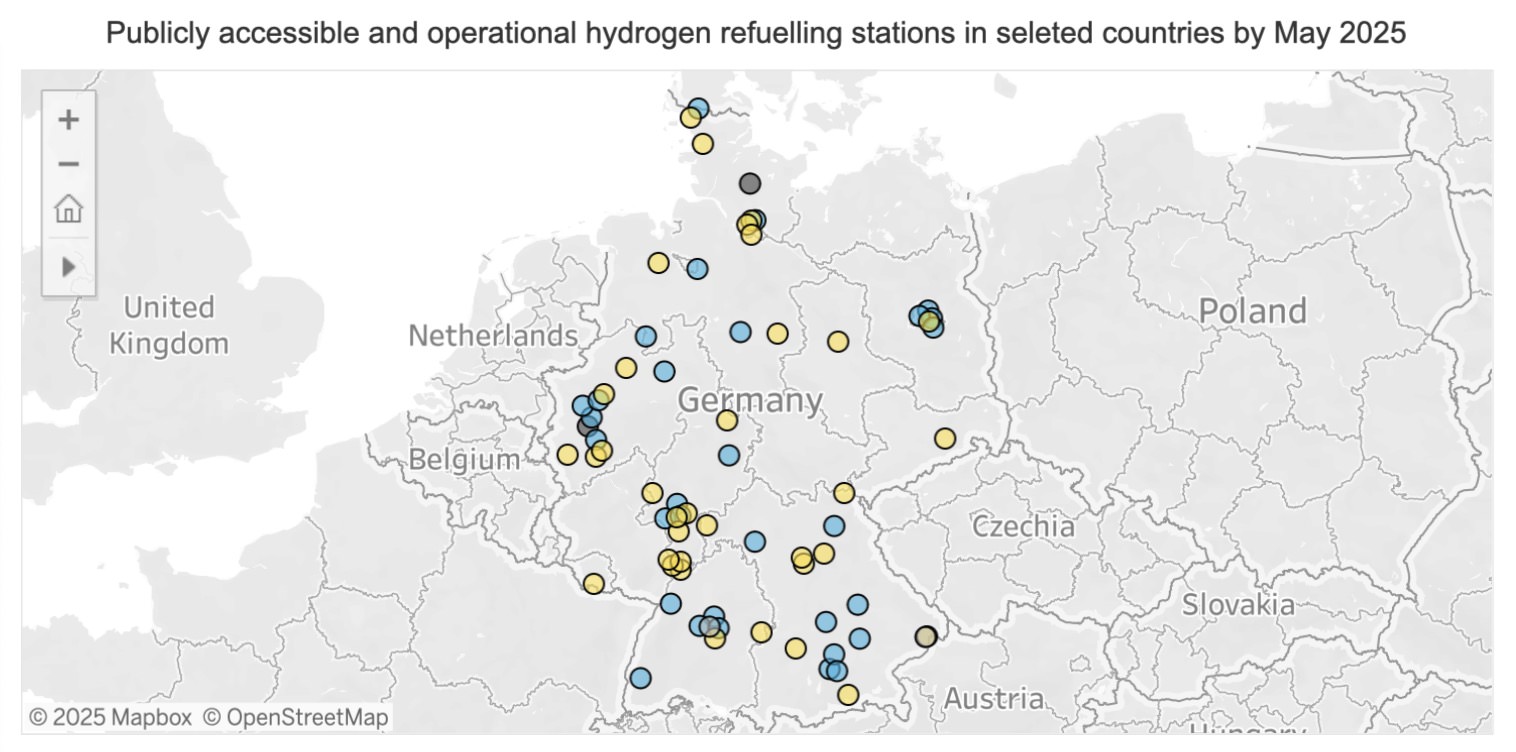

#1 Not enough refuelling stations

Europe had fewer than 300 hydrogen refuelling stations as of 2025. Most of those (72) are in Germany, followed by France and the Netherlands.

This interactive map by European Hydrogen Observatory lets you check which countries and cities have working stations, so you might want to see what’s available in your area before considering hydrogen models.

Hydrogen refuelling stations in Germany

Without easy access to refuelling, even the best FCEV won’t be practical for most drivers.

#2 Hydrogen costs and energy loss

The second key issue is the cost of hydrogen. Basic hydrogen costs roughly €3.76 to €6 per kilo, and green hydrogen (from renewables) is even pricier.

Plus, you lose a lot of energy making hydrogen compared to charging a battery directly, so it’s clear why fuel cell vehicles still struggle to compete with battery EVs on running costs.

FCEV vs ICE vs EV and Hybrid

That was a lot of info on FCEVs and how they compare to EVs in general. Since there are several types of electric vehicles on the market, together with their acronyms, here’s a quick recap to make things clearer.

|

Vehicle type |

Pros |

Cons |

|

ICE - Internal Combustion Engine |

Established, refuelling easy |

High emissions, possible future bans |

|

(B)EV - Battery Electric Vehicle |

Lower running costs, growing infrastructure |

Charging time, concerns about battery degradation |

|

HEV/PHEV - Hybrid Electric Vehicle / Plug-in Hybrid Electric Vehicle |

Lower emissions |

Still relies on fuel for longer trips |

|

FCEV - Fuel Cell Electric Vehicle |

Fast refuel, long range |

High cost, lacking infrastructure, less efficient |

Top hydrogen cars manufacturers in 2025

In Europe’s passenger segment, leading brands include:

Commercially, Iveco, Mercedes, and Volkswagen are developing vehicles.

What could your customers ask?

While you’re probably not stocking FCEVs just yet, you should be ready for questions from curious customers who’ve heard about hydrogen. So, here are the three most likely points to cover.

► Price points for FCEV cars

New Mirai and Nexo models are listed in the €60–80 k range. There are not many used models out there, so they’ll likely retain high prices due to low supply.

► Fuel costs per 100km

Hydrogen varies from region to region but it often costs more than diesel or electricity.

► Total cost of ownership

EVs have higher upfront costs than ICE vehicles, and FCEVs even more so. But faster refueling times and potential subsidies for fleet operators might help lower some of these costs.

All in all, FCEVs are still not common enough to know exactly how they perform in the long run when it comes to total cost of ownership.

Conclusion

Hydrogen-powered vehicles aren’t mainstream yet, and probably won’t be for a while, especially when it comes to passenger cars. The technology is promising, but high costs and limited refuelling infrastructure are still big obstacles.

The commercial segment is more promising. Fleets, public transport, and logistics firms are already testing hydrogen vehicles in places with better infrastructure.

For regular used car traders, hydrogen doesn’t have to become a priority, but it’s certainly useful to keep up with the development of this technology.